A recession is a period of economic decline characterized by a decrease in gross domestic product (GDP), employment, and trade. During a recession, the overall economy slows down, and businesses may suffer losses. This can lead to a decrease in consumer spending, which can further impact the economy in a negative way, creating a vicious cycle. During a recession, the government may take steps to try to stimulate the economy, such as cutting interest rates, increasing government spending, or providing tax breaks to businesses and individuals. However, these actions can also have unintended consequences, such as increasing government debt or creating inflation.

The effects of a recession can be far-reaching and long-lasting. Unemployment can increase, which can lead to poverty, homelessness, and other social problems. Businesses may go bankrupt, leaving workers without jobs and communities without a source of economic activity. The value of investments, such as stocks and real estate, can also decrease, reducing the wealth of individuals and businesses.

Here are some of the key effects of a recession:

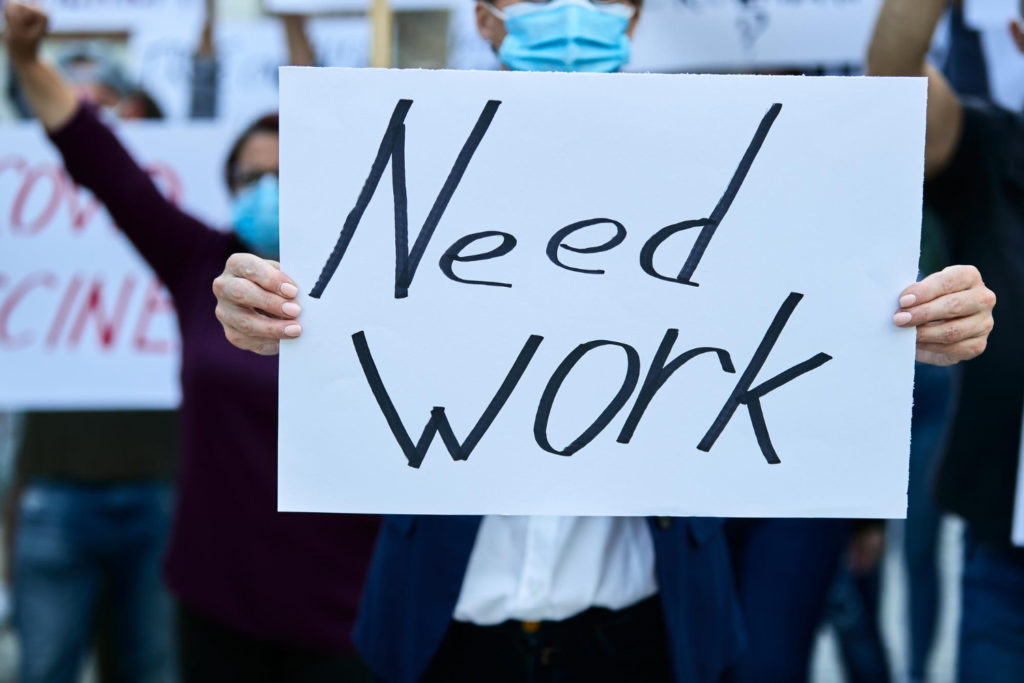

Decline in employment:

During a recession, one of the most significant effects is a decline in employment. Recessions can lead to significant job losses, as businesses struggle to survive and may be forced to lay off workers. This can result in an increase in unemployment, as more people are out of work and looking for jobs.

The impact of unemployment can be far-reaching, affecting not only the individuals who have lost their jobs but also their families and the wider economy. Unemployment can lead to a decrease in consumer spending, as people have less money to spend on goods and services. This reduction in spending can further exacerbate the economic slowdown, creating a vicious cycle.

Unemployment can also have a psychological impact on individuals, leading to a decrease in confidence and a feeling of uncertainty about the future. This can further reduce consumer spending and investment, leading to a prolonged period of economic decline.

In response to the decline in employment, governments may implement job creation programs, such as public works projects, to try and create new jobs. These programs can help to mitigate the impact of job losses and support the economy during a recession.

It’s important to note that while recessions can lead to significant job losses, they can also provide opportunities for workers to retrain and acquire new skills. This can help workers to transition to new careers and industries, which can lead to new job opportunities and growth in the economy over the long term.

A decline in employment is a common effect of a recession and it can have a significant impact on the individuals who have lost their jobs, their families and the wider economy. Governments may implement job creation programs to try and mitigate the impact of job losses, and recessions can also provide opportunities for workers to acquire new skills and transition to new careers.

Decreased Business Activity:

Decreased business activity is one of the primary effects of a recession. During a recession, businesses may experience a drop in profits, which can lead to a slowdown in production and hiring. This can have a negative impact on the overall health of the economy and can make it harder for businesses to recover from the recession.

One of the primary causes of decreased business activity during a recession is a decrease in consumer spending. When people have less money to spend, businesses have less revenue, which can lead to a slowdown in production and hiring. The decrease in consumer spending can be caused by a variety of factors, including a decrease in disposable income, a decrease in consumer confidence, or an increase in consumer debt.

Another factor that can contribute to decreased business activity during a recession is a decrease in investment spending. This can occur when businesses and individuals become less confident in the future of the economy and choose to hold onto their money instead of investing it. This decrease in investment spending can further slow economic growth and contribute to decreased business activity.

During a recession, businesses may also be forced to make difficult decisions, such as layoffs, reduced hours, or wage cuts, in order to survive. This can have a negative impact on workers and can further reduce consumer spending, making it harder for businesses to recover from the recession.

The effects of decreased business activity can be far-reaching and long-lasting. Businesses may go bankrupt, leaving workers without jobs and communities without a source of economic activity. The value of investments, such as stocks and real estate, can also decrease, reducing the wealth of individuals and businesses.

Decreased business activity is one of the primary effects of a recession and can have far-reaching and long-lasting consequences for businesses, workers, and communities. While the government can take steps to try to mitigate the effects of a recession, the best way for businesses to protect themselves is to maintain a strong financial foundation and be prepared for the possibility of reduced revenue and decreased demand for goods and services.

Decreased Consumer Spending:

Decreased consumer spending is one of the most significant effects of a recession. When people have less money to spend, businesses have less revenue, which can lead to a slowdown in production and hiring, further reducing economic growth.

One of the primary causes of decreased consumer spending during a recession is a decrease in disposable income. This can occur when people lose their jobs or have their hours reduced, reducing their overall income. The decrease in disposable income can also be caused by an increase in the cost of living, such as higher taxes, higher energy costs, or higher food prices.

Another factor that can contribute to decreased consumer spending during a recession is a decrease in consumer confidence. When people become less confident in the future of the economy, they may choose to save their money instead of spending it. This decrease in consumer confidence can also be caused by a decrease in the value of investments, such as stocks and real estate, reducing people’s overall wealth.

A third factor that can contribute to decreased consumer spending during a recession is an increase in consumer debt. When people have more debt, they have less money to spend, as they are required to make payments on their debt. This increase in consumer debt can be caused by a variety of factors, including a decrease in income, an increase in interest rates, or a decrease in the value of investments.

The effects of decreased consumer spending can be far-reaching and long-lasting. Businesses may experience a decrease in revenue, leading to layoffs, reduced hours, or wage cuts, further reducing consumer spending and economic growth. Communities may also experience a decline in economic activity, as businesses struggle to survive and workers have less money to spend.

Decreased consumer spending is one of the most significant effects of a recession and can have far-reaching and long-lasting consequences for businesses, workers, and communities. While the government can take steps to try to mitigate the effects of a recession, the best way for individuals to protect themselves is to maintain a strong financial foundation, reduce debt, and be prepared for the possibility of reduced income.

Decreased Wealth:

Decreased wealth is a common effect of a recession, as the value of investments, such as stocks and real estate, can decrease during times of economic uncertainty. This decrease in wealth can have far-reaching and long-lasting consequences for individuals, businesses, and communities.

One of the primary causes of decreased wealth during a recession is a decrease in the value of investments. This can occur when people become less confident in the future of the economy and choose to sell their investments, reducing the overall demand for stocks, bonds, and other financial assets. This decrease in demand can lead to a decrease in the value of these assets and a reduction in overall wealth.

Another factor that can contribute to decreased wealth during a recession is a decrease in the value of real estate. This can occur when people have less money to spend on housing, reducing the demand for homes and causing a decrease in home values. The decrease in home values can have a negative impact on people’s overall wealth and can make it harder for people to access the equity in their homes through refinancing or selling.

The effects of decreased wealth can be far-reaching and long-lasting. People may have less money to spend, reducing consumer spending and economic growth. Businesses may also experience a decrease in revenue, leading to layoffs, reduced hours, or wage cuts, further reducing consumer spending and economic growth. Communities may also experience a decline in economic activity, as businesses struggle to survive and workers have less money to spend.

Wealth decreased is a common effect of a recession and can have far-reaching and long-lasting consequences for individuals, businesses, and communities. While the government can take steps to try to mitigate the effects of a recession, the best way for individuals to protect themselves is to maintain a diversified portfolio of investments, reduce debt, and be prepared for the possibility of reduced wealth.

Decreased Investment:

Decreased investment is a common effect of a recession, as investors become less confident in the future of the economy and choose to reduce or avoid investments in stocks, bonds, and other financial assets. This decrease in investment can have far-reaching and long-lasting consequences for businesses, workers, and communities.

One of the primary causes of decreased investment during a recession is a decrease in consumer confidence. When people become less confident in the future of the economy, they may choose to save their money instead of investing it, reducing the overall demand for stocks, bonds, and other financial assets. This decrease in demand can lead to a decrease in the value of these assets and a reduction in overall wealth.

Another factor that can contribute to decreased investment during a recession is an increase in the risk of investment. This can occur when the economy is uncertain, making it harder for businesses to access credit and increasing the risk of default on loans. The increase in risk can make it more difficult for businesses to secure funding for new projects or expansions, reducing investment in new businesses and causing a slowdown in economic growth.

The effects of decreased investment can be far-reaching and long-lasting. Businesses may experience a decrease in revenue, leading to layoffs, reduced hours, or wage cuts, further reducing consumer spending and economic growth. Communities may also experience a decline in economic activity, as businesses struggle to survive and workers have less money to spend.

Decreased investment is a common effect of a recession and can have far-reaching and long-lasting consequences for businesses, workers, and communities. While the government can take steps to try to mitigate the effects of a recession, the best way for individuals to protect themselves is to maintain a diversified portfolio of investments, reduce debt, and be prepared for the possibility of reduced investment opportunities.

How to Overcome Impact of Recession 2023?

A recession can have far-reaching and long-lasting effects on an economy and on individuals and businesses. It is important for individuals and businesses to prepare for the possibility of a recession by maintaining a strong financial foundation and being prepared for the possibility of job loss or reduced income.

A recession can be a difficult and uncertain time, but there are steps individuals and businesses can take to prepare for the possibility of an economic downturn. By taking these steps, you can help protect yourself and your assets during a recession.

- Diversify your investments: Another important step you can take is to diversify your investments. This means spreading your money across different types of investments, such as stocks, bonds, and real estate, to reduce the risk of losing your savings if one particular asset class performs poorly. Here are some tips for diversifying your investments during a recession:

- Consider a mix of assets

- Invest in different industries

- Look beyond traditional investments

- Rebalance your portfolio regularly

- Seek professional advice

2. Review your spending: Take a close look at your spending habits and consider reducing your expenses. This will help you save money and build an emergency fund, while also reducing your financial stress if your income decreases during a recession.

Here are some tips for reviewing your spending during a recession:

- Create a budget

- Identify areas where you can cut back

- Prioritize spending

- Consider alternative options

- Avoid impulse purchases

- Be mindful of debt

4. Consider your job security: If you’re worried about losing your job during a recession, consider looking for ways to increase your job security, such as getting additional training or education. You can also consider taking on freelance or contract work to increase your income and reduce your dependence on a single source of income. During a recession, job security can become a major concern for many people. Here are some steps you can take to consider your job security during a difficult economic time:

- Stay informed

- Build your skills

- Consider freelance or contract work

- Diversify your income

- Try to Stay positive